Now that we are well into 2020 and the 2019 tax filing season is upon us, many business owners are working their way through their finances to file their taxes with the US Internal Revenue Service or the Canada Revenue Agency before that fateful April day.

One of the challenges many business owners face is presenting their financial data in a concise way that is clear to them and to their accountants or brokers. Making sure this data is accurate is crucial to abide by tax standards, and can be a challenge in itself to keep your books in line with expectations from the tax bureaus.

Thankfully, if you use Mitchell 1’s Manager SE Shop Management software, retrieving these figures is as easy as can be. With your program properly set up, you can report on a number of items that will fulfill your tax reporting for the 2019 tax year and for years to come.

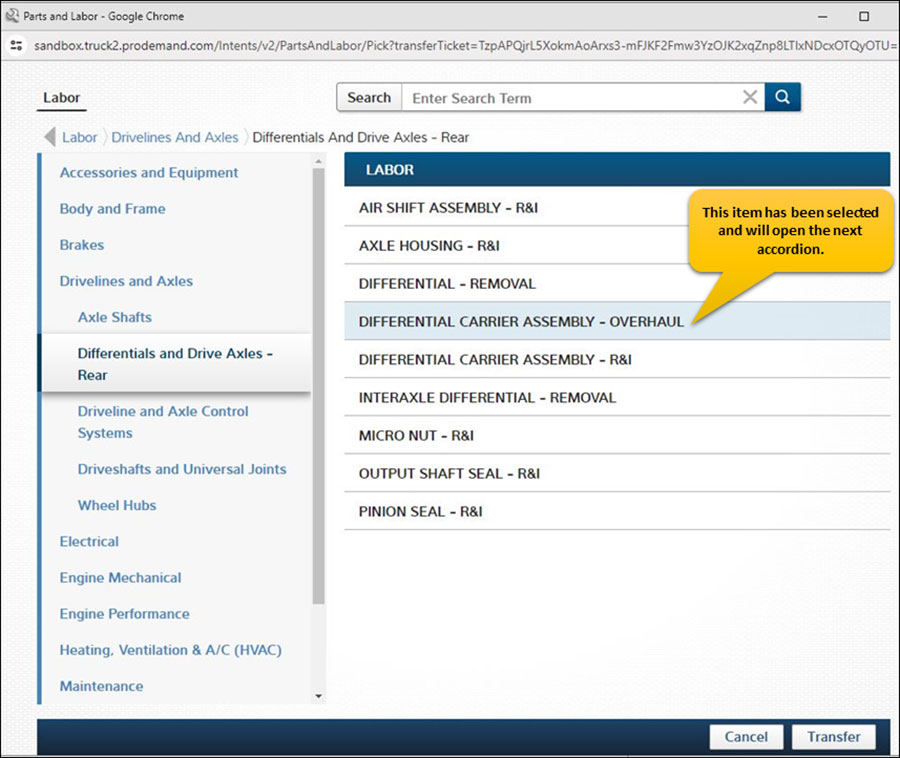

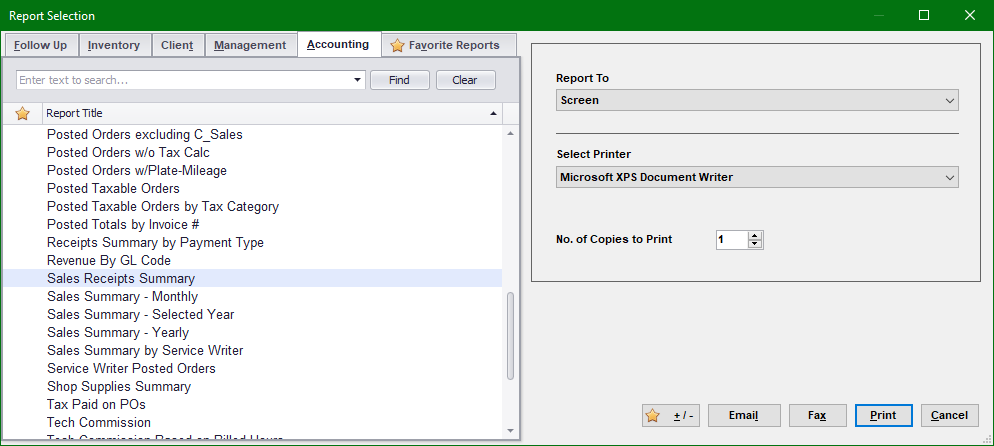

One particular report you will need is called the Sales Receipt Summary report. You can find this report and all other reports by clicking on the reports button at the top of the program. The Sales Receipt Summary report is located under the accounting tab (See Figure 1).

The Reports button is located at the top row of icons.

The Reports button is located at the top row of icons.

(Figure 1) Find the “Sales Receipt Summary” under the “Accounting” tab.

(Figure 1) Find the “Sales Receipt Summary” under the “Accounting” tab.

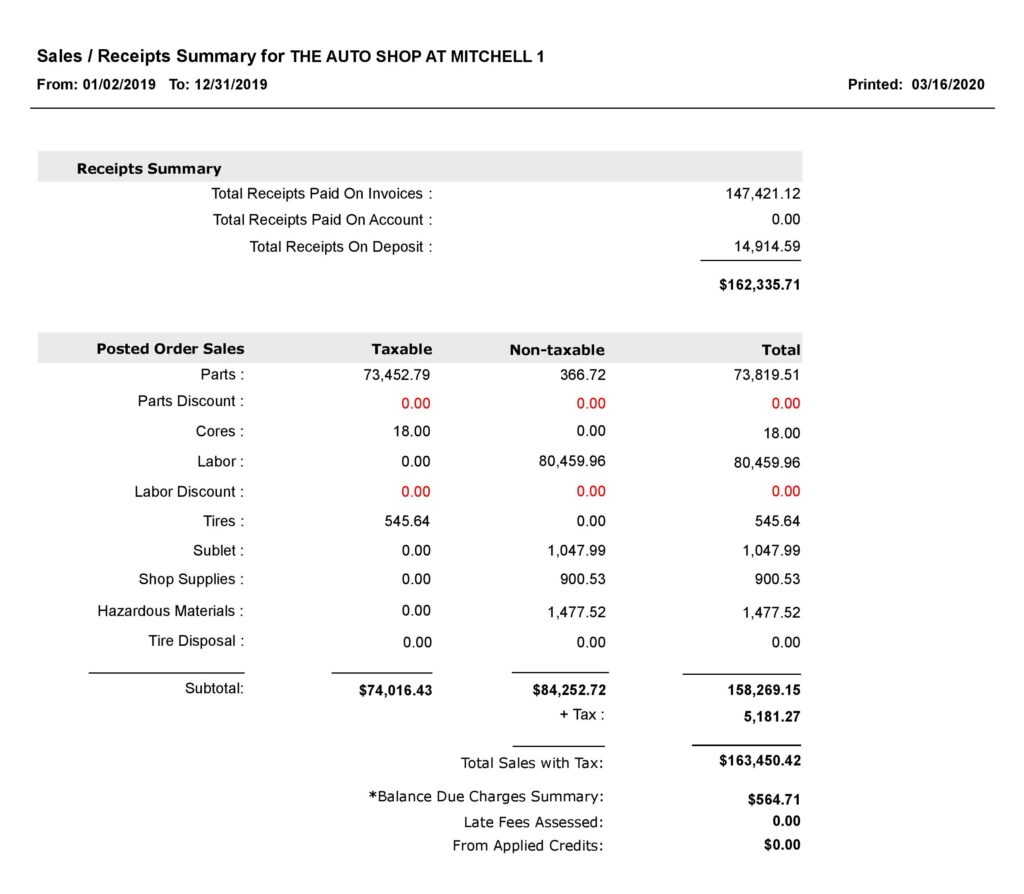

This report will give you a great summary of not only your total revenue taken in and how much tax you owe to your tax bureau, but it also gives you a breakdown of where your revenue is coming from between parts sales, labor sales and those sales that were taxed or not taxed.

There is other useful miscellaneous information shown in this report that you may use as well for your bookkeeping, such as the receipts that are pending payment (Balance Due Charges Summary) and the amount of revenue paid on invoices or on deposit (See Figure 2).

(Figure 2) The Sales Receipt Summary gives you a snapshot of the revenue of your shop for a time frame you select.

(Figure 2) The Sales Receipt Summary gives you a snapshot of the revenue of your shop for a time frame you select.

This report is the best one to determine your revenue and taxes to be paid, as it records and categorizes your shop’s revenue stream. Using this report may even be enough to satisfy your revenue reporting to the appropriate tax agencies. But in the case that it isn’t enough, there are other reports that your accountant or tax professional may require to further satisfying your yearly reporting.

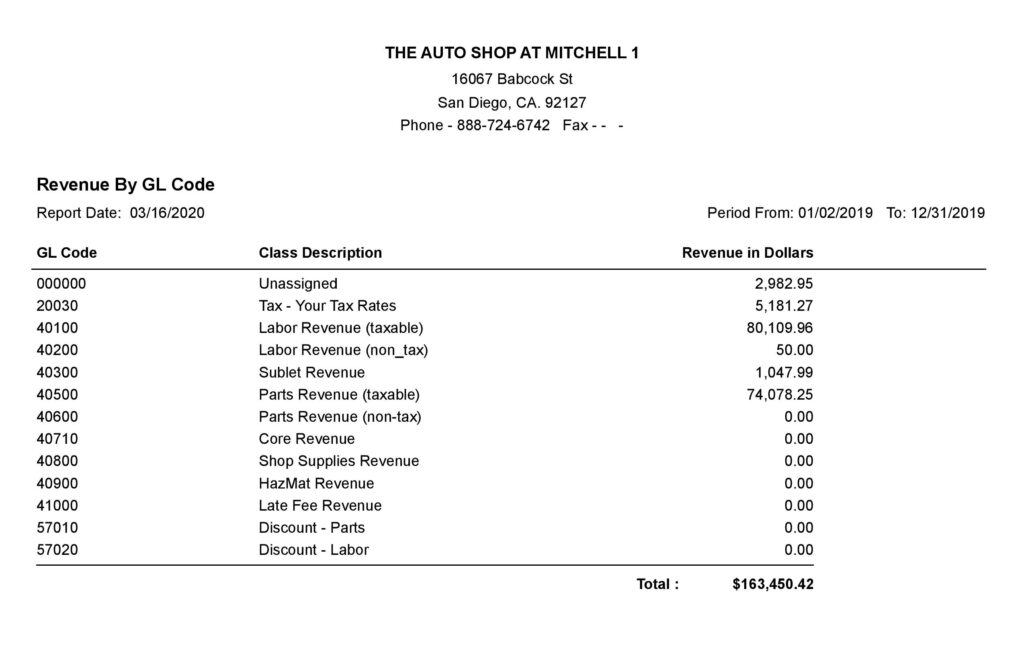

If you need to track special kinds of revenues, such as core charges, emissions testing, or warranty repairs, you could use the Revenue by GL Code report to see these special revenues separated from your standard revenues. This report requires a bare minimum setup for the program to properly place the revenue in the proper income accounts, or “bins” and display the values for each account. Without the minimum setup within the program, the values in the report could be slightly or wildly inaccurate, which highlights the importance of proper Manager SE setup. The sample below (See Figure 3) shows an example of the Revenue by GL code report, but with an incomplete setup.

(Figure 3) The Revenue by GL Code Report is also a snapshot of revenue for your shop, but can be inaccurate without proper program setup.

(Figure 3) The Revenue by GL Code Report is also a snapshot of revenue for your shop, but can be inaccurate without proper program setup.

If you compare the two reports, you will see that the Total Revenue in the GL Code report matches the Total Sales in the Sales Receipt Summary report, but you can also see that the revenue classes differ in totals; even the tax totals differ. When faced with this situation, which report would you trust? How can you determine which report to give to your accountant or tax professional?

Thus you can see the importance of having your Manager SE Shop Management software set up properly to help avoid these issues. We know that every shop operates differently and takes in revenue just as differently. You may have specific account types and revenue streams you’d like to track and report, items that are necessary to conform to your state and federal tax laws and also those that satisfy your own curiosities on how well your business is running.

The Mitchell 1 Technical Support team can help you verify that your software is set up is properly to print these two reports (and numerous others) with the information you have entered into the system. Always verify your results with your accountant or tax professional.